Navigating Jewellery Finance with Less-Than-Perfect Credit: A Comprehensive Guide

Related Articles: Navigating Jewellery Finance with Less-Than-Perfect Credit: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Jewellery Finance with Less-Than-Perfect Credit: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Jewellery Finance with Less-Than-Perfect Credit: A Comprehensive Guide

The allure of exquisite jewellery is undeniable, but the cost can be a significant barrier. Fortunately, jewellery finance options can bridge the gap, allowing individuals to acquire their dream pieces without immediate full payment. However, for those with less-than-perfect credit, accessing these options might seem daunting. This comprehensive guide delves into the intricacies of jewellery finance for individuals with credit challenges, offering valuable insights and actionable steps to navigate this process successfully.

Understanding Credit Scores and Their Impact on Jewellery Finance

A credit score is a numerical representation of an individual’s creditworthiness, reflecting their history of borrowing and repayment. Lenders utilize these scores to assess the risk associated with extending credit. A lower credit score typically indicates a higher risk, potentially leading to higher interest rates, stricter eligibility requirements, or outright rejection of applications.

Navigating Jewellery Finance with Less-Than-Perfect Credit: A Practical Approach

While a lower credit score may present challenges, it does not necessarily preclude access to jewellery finance. Several strategies can enhance the likelihood of approval and secure favorable terms:

-

Improve Your Credit Score: Before applying for jewellery finance, consider taking steps to improve your credit score. This can involve paying bills on time, reducing existing debt, and disputing any errors on your credit report.

-

Explore Specialized Lenders: Some lenders specialize in providing financial products to individuals with less-than-perfect credit. These lenders often have more flexible eligibility criteria and may offer higher interest rates to offset the increased risk.

-

Consider Secured Loans: Secured loans require collateral, such as a valuable asset, to guarantee repayment. This can significantly improve your chances of approval, even with a lower credit score.

-

Seek Pre-Approval: Contacting multiple lenders and obtaining pre-approval can provide valuable insights into your eligibility and the interest rates you may qualify for. This process allows you to compare offers and choose the most favorable option.

-

Shop Around and Compare Offers: Don’t settle for the first offer you receive. Thoroughly compare interest rates, repayment terms, and any associated fees from different lenders to secure the most competitive deal.

-

Consider Smaller Purchases: If your credit score is significantly lower, consider starting with smaller jewellery purchases that require less financing. Building a positive repayment history on smaller loans can improve your credit score, making it easier to access larger loans in the future.

-

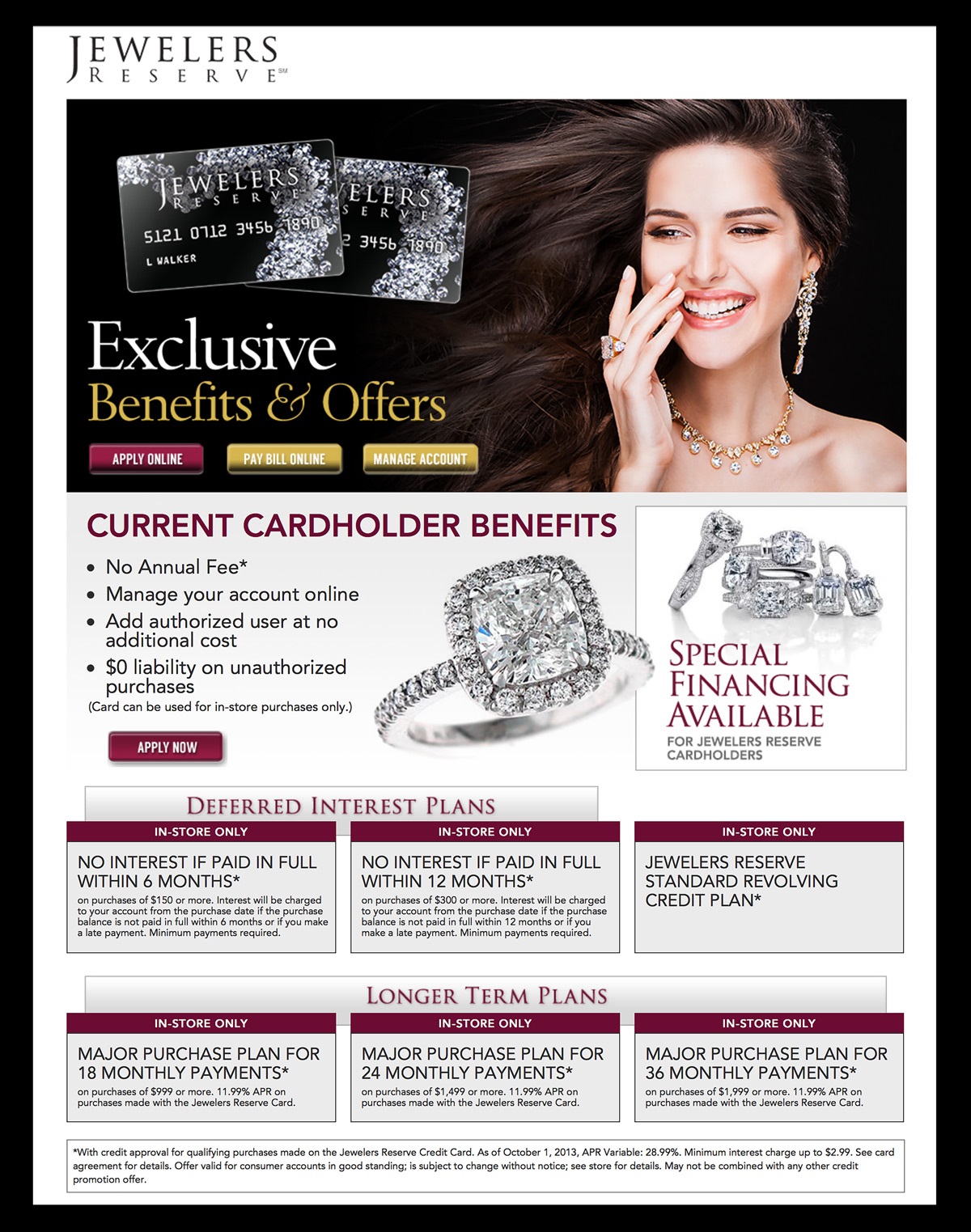

Explore Alternative Financing Options: Some jewellery retailers offer their own financing programs, potentially offering more flexible terms than traditional lenders. Additionally, consider options like layaway plans or payment plans that allow you to spread the cost of your purchase over time.

Frequently Asked Questions (FAQs) about Jewellery Finance with Less-Than-Perfect Credit

Q1: What is the minimum credit score required for jewellery finance?

A: There is no universal minimum credit score requirement for jewellery finance. Each lender has its own criteria, which may vary depending on the loan amount, loan type, and other factors. However, a higher credit score generally improves your chances of approval and secures more favorable terms.

Q2: Can I get jewellery finance with a bad credit history?

A: Yes, it is possible to obtain jewellery finance with a bad credit history. However, you may face higher interest rates, stricter eligibility requirements, or a smaller loan amount. Exploring specialized lenders and secured loans can increase your chances of approval.

Q3: What are the risks associated with jewellery finance for individuals with bad credit?

A: Individuals with less-than-perfect credit may face higher interest rates, longer repayment terms, and additional fees. Additionally, late or missed payments can negatively impact your credit score, potentially making it more difficult to secure future loans.

Q4: What are the benefits of using jewellery finance with bad credit?

A: Jewellery finance can allow individuals with less-than-perfect credit to acquire their dream pieces without immediate full payment. It can also help build a positive credit history, which can improve future borrowing opportunities.

Q5: How can I improve my credit score to qualify for better jewellery finance options?

A: To improve your credit score, focus on paying bills on time, reducing existing debt, and disputing any errors on your credit report. Consider using a credit monitoring service to track your progress and identify any potential issues.

Tips for Successful Jewellery Finance with Less-Than-Perfect Credit

- Start with a Realistic Budget: Determine your affordable monthly payment amount to avoid overstretching your finances.

- Research Lenders Thoroughly: Compare interest rates, fees, and repayment terms from multiple lenders to find the most suitable option.

- Read the Fine Print: Carefully review the loan agreement before signing, paying attention to any hidden fees or penalties.

- Maintain a Good Payment History: Make timely payments to avoid late fees and maintain a positive credit score.

- Consider Consolidating Debt: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate to improve your credit score and free up cash flow.

Conclusion: Embracing Opportunities for Responsible Jewellery Ownership

Navigating jewellery finance with less-than-perfect credit requires careful planning, research, and a proactive approach. By understanding your credit score, exploring specialized lenders, and implementing strategies to improve your financial standing, individuals can increase their chances of securing favorable terms and achieving their jewellery aspirations responsibly. Remember, responsible financial practices are crucial for building a positive credit history and unlocking future financial opportunities.

.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating Jewellery Finance with Less-Than-Perfect Credit: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!