Navigating the Labyrinth: Understanding Jewelry HSN Codes for GST Compliance

Related Articles: Navigating the Labyrinth: Understanding Jewelry HSN Codes for GST Compliance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Labyrinth: Understanding Jewelry HSN Codes for GST Compliance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Labyrinth: Understanding Jewelry HSN Codes for GST Compliance

The world of jewelry, with its glittering allure and intricate craftsmanship, can sometimes feel like a labyrinth. Add the complexities of Goods and Services Tax (GST) regulations, and the journey can become even more challenging. However, understanding the intricacies of HSN codes for jewelry is crucial for ensuring smooth GST compliance, managing inventory, and navigating the intricacies of tax calculations.

This article aims to demystify the concept of HSN codes for jewelry, shedding light on their significance, application, and practical implications.

Understanding HSN Codes: A Foundation for GST Compliance

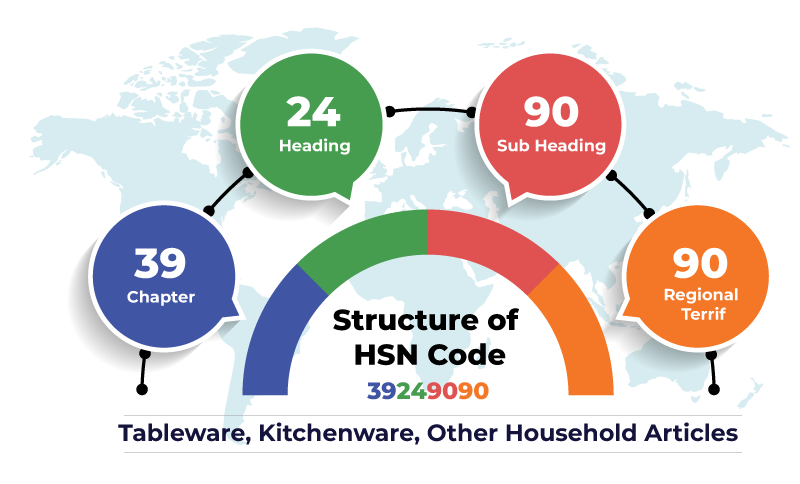

Harmonized System (HS) codes, often referred to as HSN codes, are a globally recognized system for classifying traded goods. These six-digit codes provide a standardized language for describing and identifying products, enabling efficient customs procedures and tax administration.

Within the Indian context, HSN codes play a pivotal role in GST compliance. They serve as a foundation for:

- Accurate GST Rate Determination: Each HSN code is linked to a specific GST rate, ensuring that the correct tax is levied on jewelry items.

- Streamlined Inventory Management: HSN codes provide a systematic way to categorize and manage jewelry inventory, simplifying stock tracking and accounting processes.

- Simplified GST Returns Filing: By accurately classifying jewelry with the appropriate HSN codes, businesses can effortlessly generate GST returns, minimizing errors and potential penalties.

- Enhanced Trade Facilitation: HSN codes foster smoother trade transactions by providing a common language for communication between businesses, customs authorities, and other stakeholders.

Decoding Jewelry HSN Codes: A Comprehensive Guide

The HSN code structure for jewelry is based on the HS nomenclature, with specific codes allocated for various types of jewelry and precious metals. Here’s a breakdown of key HSN codes for jewelry, categorized by material and type:

1. Gold Jewelry

- 7113.11.00: This code encompasses gold jewelry, including necklaces, bracelets, earrings, rings, pendants, and other decorative items.

- 7113.19.00: This code covers gold jewelry set with precious stones, such as diamonds, emeralds, rubies, and sapphires.

- 7113.20.00: This code includes gold jewelry set with semi-precious stones, including pearls, onyx, turquoise, and amethyst.

- 7113.91.00: This code covers gold jewelry plated with precious metals, such as platinum or silver.

- 7113.99.00: This code encompasses other types of gold jewelry not specifically mentioned above.

2. Silver Jewelry

- 7114.11.00: This code covers silver jewelry, including necklaces, bracelets, earrings, rings, and pendants.

- 7114.19.00: This code includes silver jewelry set with precious stones.

- 7114.20.00: This code encompasses silver jewelry set with semi-precious stones.

- 7114.91.00: This code covers silver jewelry plated with precious metals.

- 7114.99.00: This code encompasses other types of silver jewelry not specifically mentioned above.

3. Platinum Jewelry

- 7115.11.00: This code covers platinum jewelry, including necklaces, bracelets, earrings, rings, and pendants.

- 7115.19.00: This code includes platinum jewelry set with precious stones.

- 7115.20.00: This code encompasses platinum jewelry set with semi-precious stones.

- 7115.91.00: This code covers platinum jewelry plated with other precious metals.

- 7115.99.00: This code encompasses other types of platinum jewelry not specifically mentioned above.

4. Other Precious Metal Jewelry

- 7116.10.00: This code covers jewelry made from other precious metals like palladium, rhodium, and iridium.

- 7116.90.00: This code encompasses other types of jewelry made from precious metals not specifically mentioned above.

5. Imitation Jewelry

- 7117.10.00: This code covers imitation jewelry made from base metals like copper, brass, or nickel.

- 7117.90.00: This code encompasses other types of imitation jewelry not specifically mentioned above.

6. Jewelry Components

- 7113.29.00: This code covers jewelry components made from precious metals, including chains, clasps, and settings.

- 7114.29.00: This code covers jewelry components made from silver, including chains, clasps, and settings.

- 7115.29.00: This code covers jewelry components made from platinum, including chains, clasps, and settings.

7. Jewelry Stones

- 7103.10.00: This code covers diamonds, both rough and cut.

- 7103.20.00: This code covers other precious stones, including emeralds, rubies, and sapphires.

- 7103.90.00: This code covers semi-precious stones, including pearls, onyx, turquoise, and amethyst.

Navigating the HSN Code Labyrinth: Practical Tips for Businesses

- Consult with GST Experts: Engage with a qualified GST consultant to understand the specific HSN codes applicable to your jewelry inventory.

- Stay Updated on GST Notifications: Regularly monitor GST notifications and circulars issued by the government to ensure compliance with any changes in HSN code classification or GST rates.

- Maintain Accurate Records: Keep meticulous records of your inventory, including the HSN codes assigned to each item. This will facilitate accurate GST returns filing.

- Use GST Software: Utilize GST-compliant software to manage your inventory, calculate GST, and generate returns, simplifying the process and minimizing errors.

- Seek Clarification When Needed: If you encounter any ambiguity or uncertainty regarding HSN code application, seek clarification from the GST authorities or a qualified GST consultant.

FAQs on Jewelry HSN Codes for GST

1. What are the implications of using the wrong HSN code for jewelry?

Using an incorrect HSN code can result in several consequences, including:

- Incorrect GST Calculation: This can lead to underpayment or overpayment of taxes, potentially resulting in penalties.

- Delayed Customs Clearance: Incorrect HSN codes can hinder smooth customs clearance, delaying shipments and impacting business operations.

- Auditing and Penalties: The GST authorities may conduct audits to verify the accuracy of HSN code usage. Using incorrect codes can result in fines and penalties.

2. How can I determine the correct HSN code for my jewelry items?

To determine the correct HSN code, refer to the GST Handbook or consult with a GST expert. You can also use online resources provided by the GST authorities or reputable tax advisory firms.

3. Is there a specific HSN code for handcrafted jewelry?

The HSN code for handcrafted jewelry will depend on the material used and the type of jewelry. For example, handcrafted gold jewelry would be classified under HSN code 7113.11.00.

4. How do I handle the GST on jewelry imported from another country?

Imported jewelry is subject to GST upon arrival in India. The applicable GST rate will depend on the HSN code of the jewelry. It is essential to comply with customs regulations and ensure accurate declaration of the HSN code.

5. Can I change the HSN code for my jewelry items after they have been registered?

You can change the HSN code for your jewelry items if the classification is incorrect or if the GST rate has changed. However, it is essential to follow the procedures outlined by the GST authorities.

Conclusion: Embracing Transparency and Compliance

Understanding and utilizing HSN codes for jewelry is crucial for businesses to navigate the complexities of GST compliance. By adhering to the correct HSN codes, businesses can ensure accurate GST calculation, streamline inventory management, and facilitate smooth trade transactions. This fosters transparency, minimizes risks, and contributes to a robust and compliant business ecosystem.

Embrace the knowledge of HSN codes and navigate the jewelry trade with confidence, ensuring a smooth and successful journey within the framework of GST regulations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Labyrinth: Understanding Jewelry HSN Codes for GST Compliance. We hope you find this article informative and beneficial. See you in our next article!