Navigating the Landscape of Jewelry Insurance Valuation Costs

Related Articles: Navigating the Landscape of Jewelry Insurance Valuation Costs

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Jewelry Insurance Valuation Costs. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Jewelry Insurance Valuation Costs

Jewelry, a symbol of beauty, sentiment, and often significant financial value, demands careful consideration when it comes to insurance. A jewelry insurance valuation is a crucial step in safeguarding your precious possessions, ensuring you receive adequate compensation in the event of loss or damage. This article delves into the intricacies of jewelry insurance valuation cost, offering a comprehensive understanding of the factors that influence pricing, the benefits of obtaining a professional valuation, and practical tips for navigating the process.

Understanding the Essence of Jewelry Insurance Valuation

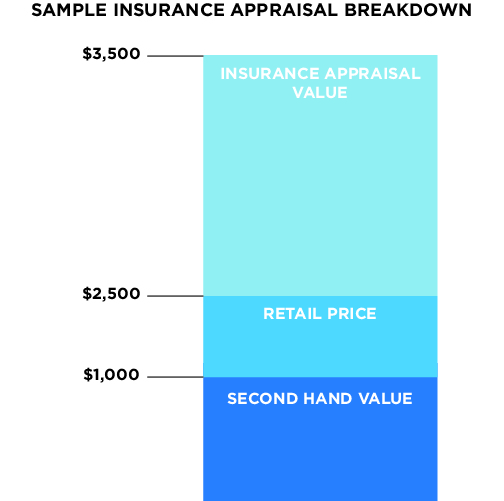

A jewelry insurance valuation is a formal assessment of the market value of your jewelry, conducted by a qualified appraiser. It is not simply an appraisal of the piece’s sentimental value; it determines the fair market price at which your jewelry could be sold to a willing buyer. This valuation serves as the foundation for your insurance policy, dictating the amount of compensation you would receive in the unfortunate event of loss, theft, or damage.

Factors Influencing Jewelry Insurance Valuation Costs

The cost of a jewelry insurance valuation is not a one-size-fits-all proposition. Several factors contribute to the final price, and understanding these nuances is essential for making informed decisions.

-

Type of Jewelry: The type of jewelry plays a significant role in determining the valuation cost. Diamonds, gemstones, precious metals, and intricate designs often require specialized expertise and more extensive analysis, leading to higher valuation fees.

-

Age and History: Antique or vintage jewelry may necessitate additional research to establish its historical significance and market value, increasing the valuation cost.

-

Rarity and Uniqueness: Rare or unique pieces, such as custom-designed jewelry or pieces with exceptional craftsmanship, demand more in-depth assessment and may have higher valuation fees.

-

Location and Appraiser Expertise: The geographic location and the appraiser’s expertise can influence the cost. Appraisers with specialized knowledge and certifications in specific types of jewelry may charge higher fees.

-

Valuation Method: The chosen valuation method can also impact the cost. A comprehensive appraisal involving detailed analysis, photography, and documentation will generally be more expensive than a simple verbal assessment.

The Benefits of Professional Jewelry Insurance Valuation

Obtaining a professional jewelry insurance valuation offers a range of benefits that extend beyond simply meeting insurance requirements.

-

Accurate Compensation: A professional valuation ensures that you are adequately insured for the true value of your jewelry, providing peace of mind in the event of loss or damage.

-

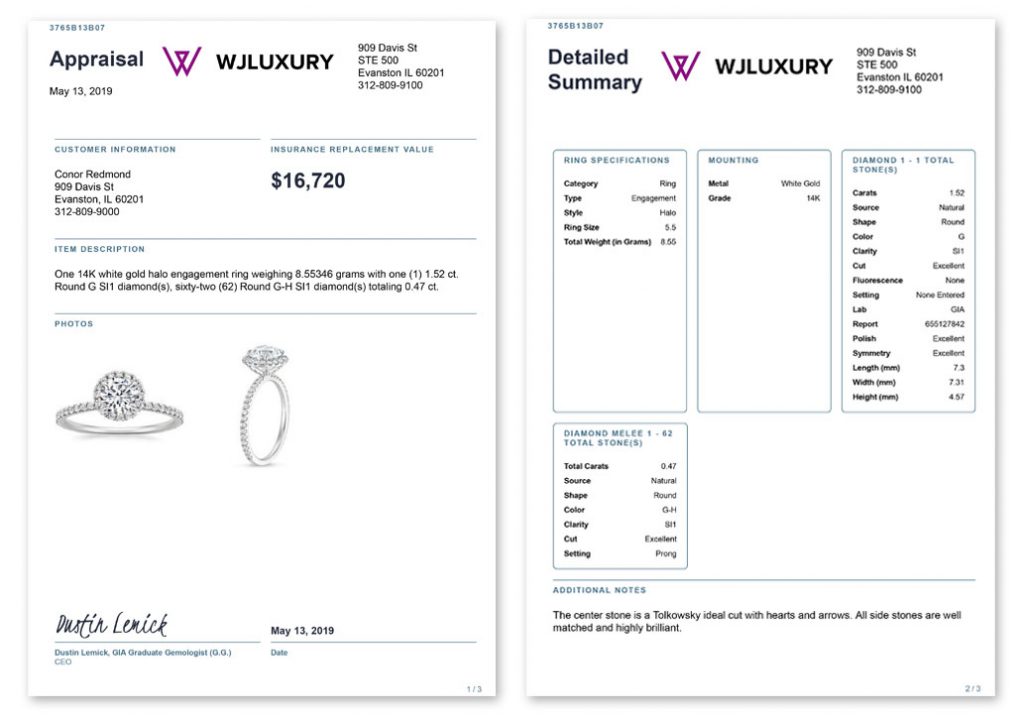

Proof of Value: The valuation report serves as irrefutable documentation of your jewelry’s value, which is crucial for insurance claims and legal purposes.

-

Market Insight: The valuation process provides valuable market insights into the current value of your jewelry, helping you make informed decisions about its care, maintenance, and potential sale.

-

Preventative Measures: A professional valuation can highlight potential risks or vulnerabilities associated with your jewelry, enabling you to take appropriate preventative measures to safeguard your possessions.

-

Investment Tracking: For valuable jewelry considered an investment, regular valuations can track its appreciation or depreciation over time, providing valuable data for financial planning.

Navigating the Jewelry Insurance Valuation Process

The process of obtaining a jewelry insurance valuation is straightforward but requires careful consideration.

-

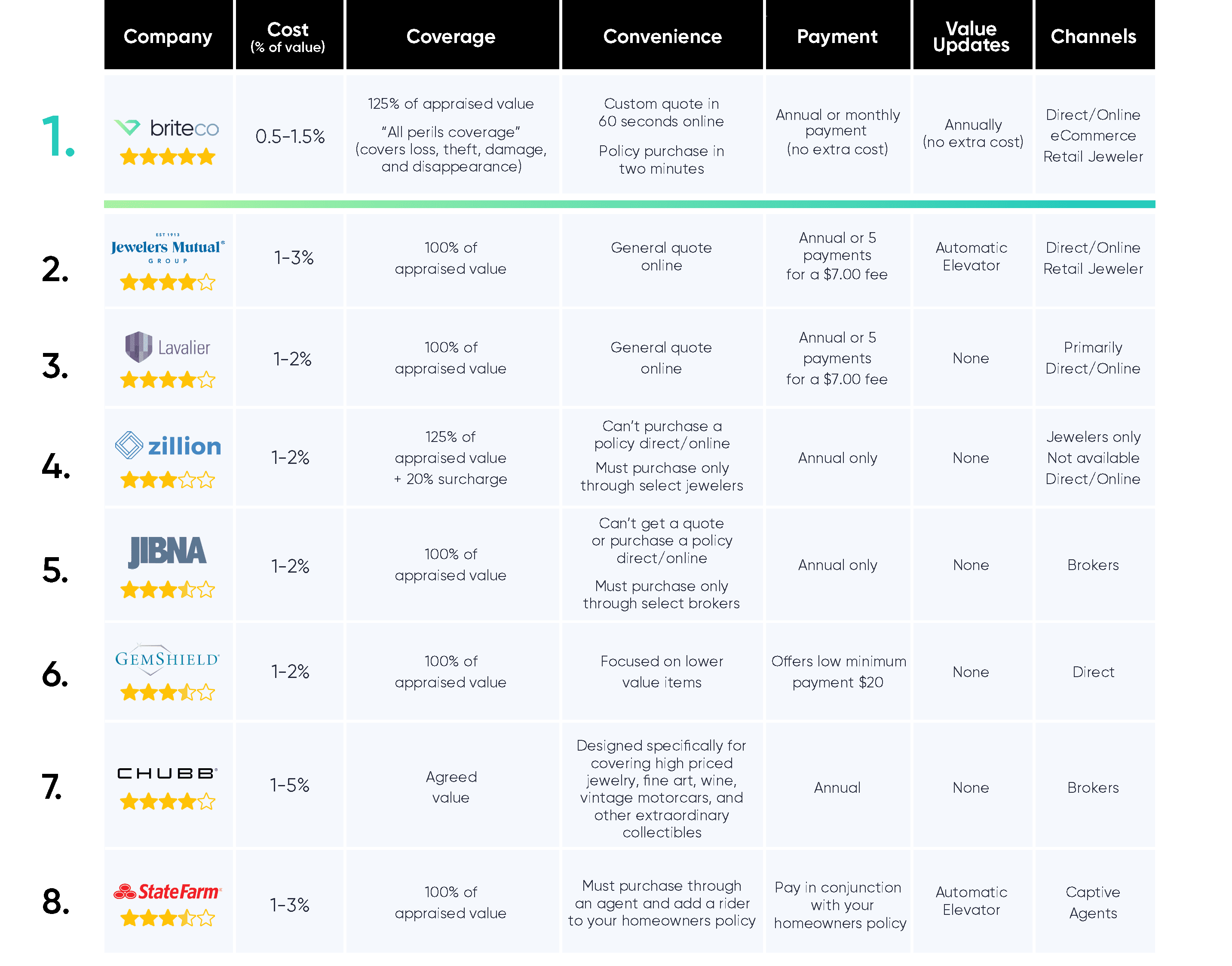

Choosing a Qualified Appraiser: Selecting a reputable appraiser with expertise in your specific type of jewelry is crucial. Look for appraisers with industry certifications and experience, and check their credentials with professional organizations.

-

Preparing for the Appraisal: Gather all relevant documentation, such as purchase receipts, original certificates, and previous appraisals. Clean your jewelry and remove any loose stones or settings.

-

Understanding the Valuation Report: The valuation report should include detailed descriptions of your jewelry, photographs, market analysis, and the determined value. Ensure you understand the report’s contents and any associated terms or conditions.

-

Maintaining Your Valuation: Regularly review and update your jewelry insurance valuation, especially if your jewelry undergoes repairs, alterations, or significant market fluctuations.

FAQs Regarding Jewelry Insurance Valuation Cost

Q: How often should I have my jewelry appraised?

A: It is generally recommended to have your jewelry appraised every 3-5 years to account for market fluctuations and changes in the value of precious metals and gemstones.

Q: Can I use a previous appraisal for my insurance?

A: While you can use a previous appraisal, it is advisable to obtain a new appraisal for your insurance policy, especially if it has been more than 5 years since the last valuation. Market conditions and the value of your jewelry may have changed significantly.

Q: What if my jewelry is not insured for its full value?

A: If your jewelry is not insured for its full value, you may receive less compensation in the event of loss or damage. It is essential to ensure your insurance policy adequately reflects the current market value of your jewelry.

Q: What are the common types of jewelry insurance policies?

A: Common jewelry insurance policies include all-risk coverage, which covers loss or damage from any cause, and named perils coverage, which covers specific perils such as theft, fire, or natural disasters.

Q: What should I do if my jewelry is lost or damaged?

A: In the event of loss or damage, contact your insurance company immediately and file a claim. Provide them with your valuation report and any other relevant documentation.

Tips for Saving on Jewelry Insurance Valuation Costs

- Shop Around: Obtain quotes from multiple appraisers to compare pricing and expertise.

- Consider Online Valuation Services: Online valuation services can offer a cost-effective option for basic valuations, but it is important to research their credibility and limitations.

- Negotiate Fees: Discuss the valuation fee with the appraiser upfront and negotiate if possible.

- Bundle Services: Some appraisers offer discounted rates for multiple valuations or combined appraisal and insurance services.

- Seek Expert Advice: Consult with your insurance broker or a financial advisor to determine the most appropriate valuation method and insurance coverage for your needs.

Conclusion

A jewelry insurance valuation is an essential investment in protecting your valuable possessions. By understanding the factors that influence valuation costs, the benefits of professional appraisal, and the steps involved in the process, you can make informed decisions to safeguard your jewelry and ensure adequate compensation in the event of loss or damage. Regularly reviewing and updating your valuation, coupled with appropriate insurance coverage, provides peace of mind and financial security for your treasured jewelry.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Jewelry Insurance Valuation Costs. We thank you for taking the time to read this article. See you in our next article!