The Fluctuating Landscape of Gold Prices in the Jewelry Market: A Comprehensive Guide

Related Articles: The Fluctuating Landscape of Gold Prices in the Jewelry Market: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to The Fluctuating Landscape of Gold Prices in the Jewelry Market: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Fluctuating Landscape of Gold Prices in the Jewelry Market: A Comprehensive Guide

Gold, a precious metal coveted for its beauty, durability, and inherent value, plays a central role in the jewelry industry. Its price, however, is not static but rather a dynamic entity influenced by a complex interplay of factors. Understanding these factors and the mechanisms governing gold price fluctuations is crucial for both consumers and industry professionals alike.

Factors Influencing Gold Prices

The price of gold is subject to various influences, both internal and external to the jewelry market. These factors can be broadly categorized as follows:

1. Global Economic Conditions:

- Interest Rates: When interest rates rise, gold becomes less attractive as an investment, as investors can earn higher returns on bonds and other fixed-income instruments. Conversely, declining interest rates often lead to increased demand for gold as a safe haven asset.

- Inflation: During periods of high inflation, gold tends to appreciate in value, serving as a hedge against currency devaluation.

- Economic Uncertainty: In times of economic turmoil or political instability, investors often turn to gold as a safe haven asset, driving its price upwards.

2. Supply and Demand Dynamics:

- Gold Mining Production: Global gold production levels directly impact supply. Increased mining output can lead to lower prices, while production constraints can drive prices up.

- Investment Demand: Gold is a popular investment asset, and changes in investor sentiment can significantly influence demand.

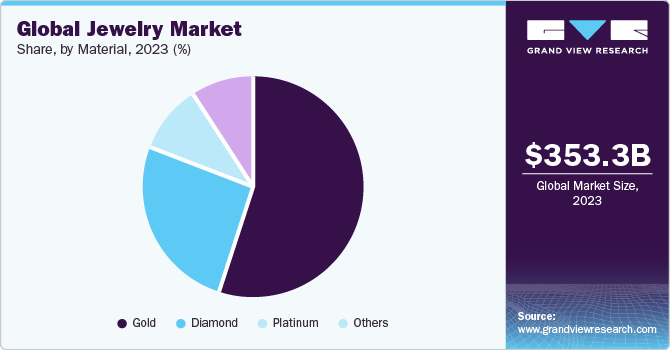

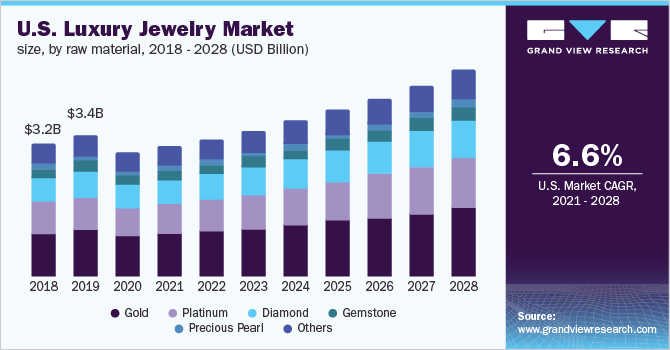

- Jewelry Demand: Consumer demand for gold jewelry is a major driver of gold consumption. Factors like economic growth, cultural trends, and fashion preferences play a role in shaping jewelry demand.

3. Monetary Policies:

- Central Bank Policies: Central banks, particularly in countries with large gold reserves, can influence gold prices through their buying and selling activities.

- Currency Fluctuations: Changes in exchange rates can affect the price of gold, as it is priced in US dollars. A weakening dollar can lead to an increase in gold prices.

4. Geopolitical Events:

- International Conflicts: Political instability and conflicts can disrupt gold supply chains and increase demand for the metal as a safe haven asset.

- Trade Wars: Trade tensions and sanctions can impact gold prices, particularly if they involve major gold-producing nations.

5. Speculation and Market Sentiment:

- Futures Market Activity: Speculation in the gold futures market can create price volatility, as traders buy and sell contracts for future delivery of gold.

- Investor Sentiment: Changes in investor sentiment, driven by news events or market trends, can influence gold prices.

Understanding Gold Price Fluctuations

The price of gold is constantly in motion, reflecting the interplay of the factors discussed above. It is essential to understand that gold prices can be volatile, exhibiting both short-term fluctuations and long-term trends.

Short-term Fluctuations:

- News-Driven Volatility: Gold prices can be significantly impacted by news events, such as economic data releases, geopolitical developments, and policy announcements.

- Technical Analysis: Technical analysts use charts and indicators to identify patterns in gold price movements, attempting to predict future price trends.

Long-term Trends:

- Inflationary Pressures: Over the long term, gold has historically been a good hedge against inflation.

- Economic Growth: Economic growth can impact gold prices, with strong growth often leading to lower demand for gold as a safe haven asset.

- Technological Advancements: Technological innovations in gold mining can impact production levels and influence gold prices.

Gold Price Reporting and Tracking

Staying informed about gold price movements is crucial for anyone involved in the jewelry industry. Several sources provide reliable and up-to-date gold price information:

- London Bullion Market Association (LBMA): The LBMA is a leading authority on gold pricing, providing daily gold fixings for the London market.

- Gold Spot Prices: Spot prices represent the current market price of gold for immediate delivery.

- Gold Futures Markets: Futures markets provide information on future gold prices, allowing participants to speculate on price movements.

- Financial News Websites: Reputable financial news websites often publish real-time gold price updates and analysis.

Jewelry Gold Rate and its Significance

The jewelry gold rate refers to the price of gold used in the production of jewelry. It is a crucial factor for jewelers, as it directly affects the cost of their products and their profit margins. Understanding the factors that influence the jewelry gold rate enables jewelers to make informed decisions about pricing, inventory management, and sourcing.

Factors Affecting Jewelry Gold Rate

- Purity of Gold: Gold used in jewelry is often alloyed with other metals to enhance its durability and workability. The higher the purity of gold (measured in karats), the higher the price.

- Gold Market Fluctuations: As explained earlier, global gold prices are subject to fluctuations, which directly impact the jewelry gold rate.

- Manufacturing Costs: The costs associated with manufacturing jewelry, including labor, materials, and overhead, contribute to the overall price.

- Retail Markups: Jewelers add markups to their costs to cover their expenses and generate profit.

Importance of Jewelry Gold Rate for Consumers

Consumers need to be aware of the jewelry gold rate to make informed purchasing decisions. Understanding how gold prices fluctuate and the factors that influence them can help consumers:

- Negotiate Prices: Knowing the current gold rate empowers consumers to negotiate fair prices for gold jewelry.

- Compare Prices: Consumers can compare prices across different jewelers, taking into account the gold rate and other factors like craftsmanship and design.

- Make Informed Investment Decisions: For those considering gold jewelry as an investment, understanding the gold rate is crucial to assess potential returns.

FAQs on Jewelry Gold Rate

1. What is the current gold rate?

The current gold rate can be found on various websites and financial news outlets. It is constantly changing, so it is essential to check for the latest information.

2. How often does the gold rate change?

Gold prices fluctuate throughout the day, influenced by news events, market sentiment, and other factors.

3. Why is the gold rate different at different jewelers?

Gold rate differences can be attributed to factors like:

- Purity of Gold: Different jewelers may offer jewelry made with different karat gold.

- Manufacturing Costs: Production costs can vary based on manufacturing techniques and labor costs.

- Retail Markups: Jewelers set their own markups, which can vary based on their business model and target market.

4. How can I track the gold rate?

You can track the gold rate through various sources:

- Financial News Websites: Reputable financial news websites often publish real-time gold price updates and analysis.

- Gold Price Tracking Apps: Several mobile applications provide real-time gold price tracking and alerts.

5. Should I buy gold jewelry now or wait for the price to drop?

The decision to buy gold jewelry depends on individual financial goals and risk tolerance. There is no guarantee that gold prices will drop in the future.

Tips for Buying Gold Jewelry

- Research Current Gold Prices: Check multiple sources to get an accurate picture of the current gold rate.

- Compare Prices: Compare prices across different jewelers, taking into account the gold rate, craftsmanship, and design.

- Consider Purity: Understand the karat of gold used in the jewelry and how it affects the price.

- Ask About Markups: Inquire about the jeweler’s markups to ensure you are getting a fair price.

- Purchase from Reputable Sources: Buy gold jewelry from reputable jewelers with established reputations.

Conclusion

The jewelry gold rate is a dynamic entity influenced by a complex interplay of factors. Understanding these factors and the mechanisms governing gold price fluctuations is crucial for both consumers and industry professionals. By staying informed about current gold prices, comparing prices across different jewelers, and making informed decisions, consumers can ensure they are getting the best value for their investment in gold jewelry. Jewelers, in turn, can use their knowledge of gold rate dynamics to make informed decisions regarding pricing, inventory management, and sourcing. Ultimately, understanding the jewelry gold rate empowers all stakeholders in the jewelry industry to navigate the dynamic world of gold and its value.

Closure

Thus, we hope this article has provided valuable insights into The Fluctuating Landscape of Gold Prices in the Jewelry Market: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!