Understanding the Harmonized System Code for Jewelry: A Comprehensive Guide

Related Articles: Understanding the Harmonized System Code for Jewelry: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Harmonized System Code for Jewelry: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Harmonized System Code for Jewelry: A Comprehensive Guide

The Harmonized System (HS) Code is a standardized international nomenclature system used to classify traded goods. It plays a crucial role in international trade, facilitating customs clearance, tariff calculations, and trade statistics. Within this intricate system, jewelry holds a specific classification, with its own set of HS codes. This article provides a comprehensive guide to understanding these codes, their significance, and their practical applications.

Navigating the HS Code System: A Deeper Dive into Jewelry

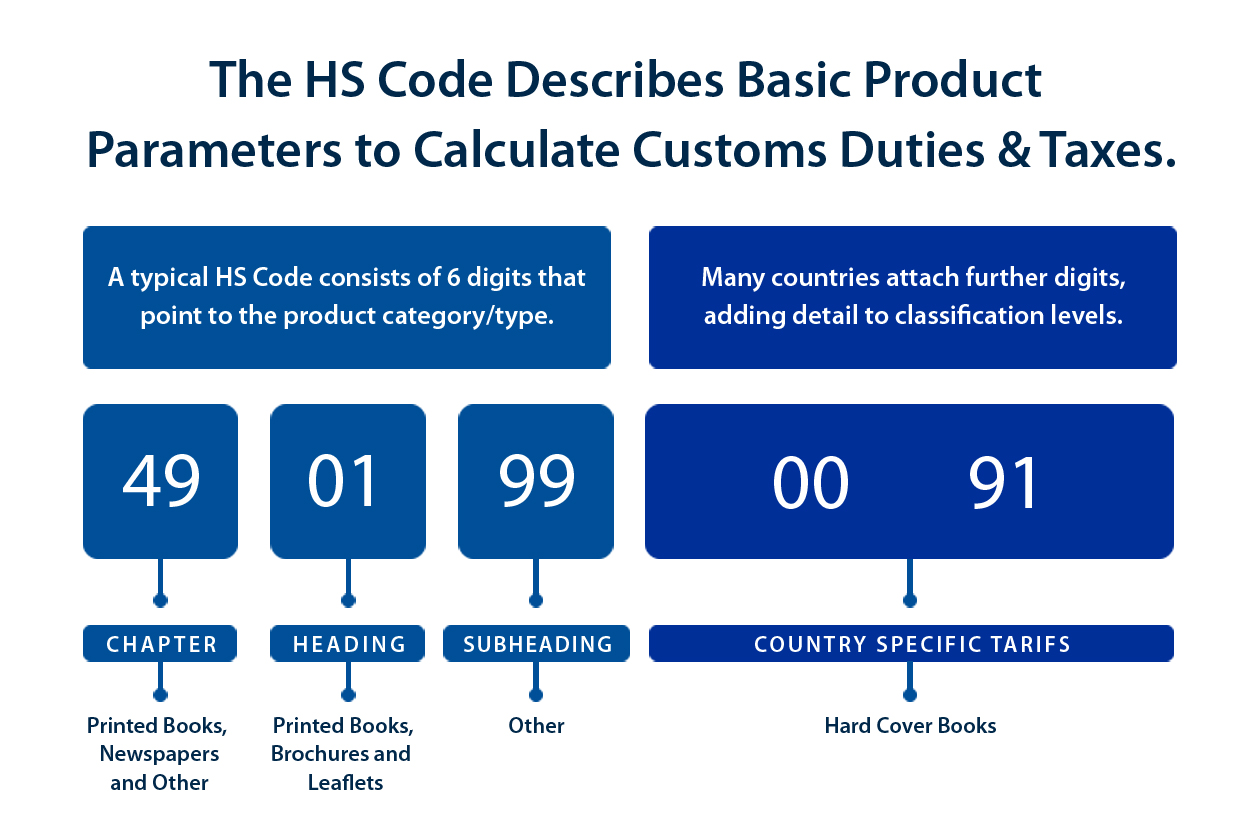

The HS Code system is structured hierarchically, with each code consisting of six digits. The first two digits represent the chapter, the next two represent the heading, and the final two digits specify the subheading. This structure allows for a detailed classification of goods, ensuring accuracy and consistency in trade documentation.

Jewelry’s HS Code Range: A Breakdown of Categories

Jewelry, classified under Chapter 71 of the HS Code, encompasses a wide range of items, each with its specific code. Here’s a breakdown of the major categories:

-

71.13: Articles of jewelry and parts thereof, of precious metal or of metal clad with precious metal

- This category covers a broad range of jewelry items, including necklaces, bracelets, earrings, rings, and pendants, crafted from precious metals such as gold, silver, platinum, and palladium. It also includes parts of these items, such as clasps, chains, and settings.

-

71.14: Articles of jewelry and parts thereof, of base metal

- This category encompasses jewelry items made from base metals like copper, brass, nickel, and stainless steel. It includes a wide variety of styles, from everyday wear to more elaborate pieces, and also includes parts like clasps and chains.

-

71.15: Articles of jewelry and parts thereof, of rolled precious metal

- This category covers jewelry items made from rolled precious metal, where a thin layer of precious metal is bonded to a base metal core. This technique is commonly used to create jewelry that resembles solid precious metal while offering a more affordable option.

-

71.16: Articles of jewelry and parts thereof, of imitation precious metal

- This category includes jewelry items made from materials that mimic the appearance of precious metals. These materials can include plated metals, alloys, and synthetic materials.

The Significance of HS Codes for Jewelry

Understanding the HS Code for jewelry is essential for various stakeholders involved in the trade:

- Exporters: Knowing the correct HS Code for their jewelry products is crucial for accurate customs declarations, ensuring smooth clearance and avoiding potential delays.

- Importers: Accurate HS Codes help importers calculate tariffs, understand import regulations, and ensure compliance with customs requirements.

- Customs Authorities: HS Codes are vital for customs authorities to classify goods, assess duties, and monitor trade patterns.

- Trade Statistics: HS Codes provide a standardized system for collecting and analyzing trade data, enabling governments and businesses to track trends and make informed decisions.

Benefits of Using the Correct HS Code for Jewelry

Using the correct HS Code for jewelry offers significant benefits:

- Reduced Trade Costs: Accurate HS Codes ensure efficient customs clearance, reducing delays and associated costs.

- Improved Compliance: Using the correct HS Code ensures compliance with international trade regulations, minimizing risks of fines and penalties.

- Accurate Tariff Calculations: The correct HS Code determines the applicable tariff rate, ensuring accurate duty payments.

- Enhanced Trade Data: Accurate HS Codes contribute to reliable trade statistics, providing valuable insights for industry analysis and policy development.

FAQs on Jewelry HS Codes

Q: How do I find the correct HS Code for my jewelry product?

A: The best resource for finding the correct HS Code is the Harmonized System Nomenclature published by the World Customs Organization (WCO). You can access this resource online or consult with a customs broker or trade specialist.

Q: Can I use the same HS Code for all types of jewelry?

A: No, each type of jewelry has a specific HS Code based on its material, design, and purpose. For example, a gold necklace will have a different HS Code than a silver ring or a brass bracelet.

Q: What happens if I use the wrong HS Code?

A: Using the wrong HS Code can lead to delays in customs clearance, incorrect tariff calculations, and potential fines or penalties.

Q: Are there any specific regulations or restrictions for jewelry imports or exports?

A: Yes, different countries may have specific regulations or restrictions on the import or export of jewelry. These regulations can vary based on the type of jewelry, its origin, and its intended use. It’s important to research and comply with the relevant regulations before engaging in any jewelry trade.

Tips for Using Jewelry HS Codes Effectively

- Consult with an Expert: Seek guidance from a customs broker or trade specialist to ensure accurate HS Code identification.

- Stay Updated: The HS Code system is regularly updated, so it’s important to stay informed of any changes that may affect your jewelry trade.

- Maintain Records: Keep detailed records of the HS Codes used for your jewelry products, including the source of the information.

- Use Online Resources: Utilize online resources such as the WCO website and trade databases to access up-to-date information on HS Codes.

Conclusion

The Harmonized System Code is a vital tool for navigating the complex world of international trade. Understanding the specific HS Codes for jewelry is essential for businesses involved in importing, exporting, and trading these products. By using the correct HS Codes, businesses can ensure smooth customs clearance, accurate tariff calculations, and compliance with international regulations. This ultimately contributes to efficient trade operations and a competitive edge in the global market.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Harmonized System Code for Jewelry: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!